8 Best Bearish Candlestick Patterns for Day Trading

In the end, it all boils down to context and the story of buyers and sellers behind the tape. Additionally, the nature of the candles can tell us when to enter with tight risk. Similarly, a daily or weekly candle is the culmination of all the trading executions achieved during that day or that week. This helps us to identify trending markets, ranging markets, and choppy markets. It also depicts us as to how to draw resistance, support, and trend line. There is nothing wrong with using non-time-based variables if that’s what you prefer.

Again, bullish confirmation is required, and it can come in the form of a long hollow candlestick or a gap up, accompanied by a heavy trading volume. An abandoned baby, also called an island reversal, is a significant pattern suggesting a major reversal in the prior directional movement. An abandoned baby top forms after an up move, while an abandoned baby bottom forms after a downtrend. Second, there is the mistake of rushing to open a trade when a pattern forms.

Thus, he devised a system of charting that gave him an edge in understanding the ebb and flow of these emotions and their effect on rice future prices. When this pattern is created during an uptrend or a downtrend, it indicates a continuation signal with the direction of the market. So at the end of the day, no pattern is a common beneficial pattern. There are multiple candlestick patterns involved to determine the nature of trade. Some even use non-time-related measures such as the number of trades made or their price range.

Benefits of using Candlestick Charts

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The doji and spinning top candles are typically found in a sideways consolidation patterns where price and trend are still trying to be discovered. As with all of these formations, the goal is to provide an entry point to go long or short with a definable risk.

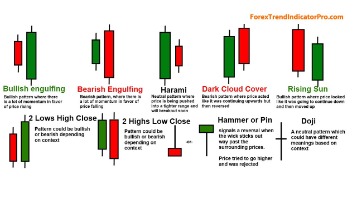

Each candlestick usually represents one day’s worth of price data about a stock. Over time, the candlesticks group into recognizable patterns that investors can use to make buying and selling decisions. A candle pattern is best read by analyzing whether it’s bullish, bearish, or neutral (indecision). Watching a candlestick pattern form can be time consuming and irritating. If you recognize a pattern and receive confirmation, then you have a basis for taking a trade. Let the market do its thing, and you will eventually get a high-probability candlestick signal.

Should I consult other tools beyond candlestick charts?

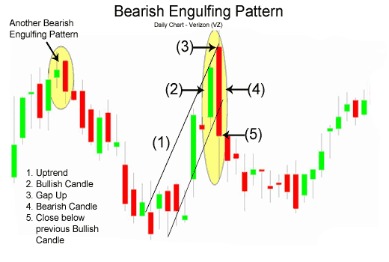

More importantly, we will discuss their significance and reveal 5 real examples of reliable candlestick patterns. Along the way, we’ll offer tips for how to practice this time-honored method of price analysis. You may have to refresh the page to continue updating the information you’re getting. This type of software may not work for day trading, but traders with longer-term trades may not care about getting minute-by-minute information. They may instead base their trading decisions on how the daily candle closes, for instance. In candlestick chart analysis, this is a pattern of two candlesticks where the first candle is a short green one engulfed by a large red candle.

The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast. To be certain it is a hammer candle, check where the next candle closes. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

The Hammer / Hanging Man

The benefit of doing a multi-timeframe analysis is that you will find patterns across all charts. For example, you can find a hammer pattern in a daily chart and a bullish engulfing in the hourly chart. For example, in a hammer candlestick, candle day trading a long shadow means that the reversal is more convincing. At times, you will identify a candlestick with just a body and without shadows. Let’s say you switch to a daily or D1 chart, where each candle represents 24 hours.

This Cardano (ADA) Resistance Level Is Extremely Important: Here’s Why – U.Today

This Cardano (ADA) Resistance Level Is Extremely Important: Here’s Why.

Posted: Sat, 09 Sep 2023 01:07:25 GMT [source]

You’d have new lower lows and a suggestion that it will become a down trend. This empty zone tells you that the price action isn’t headed anywhere. There is no clear up or down trend, the market is at a standoff. Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price just above the open – like a star falling to the ground.

Shrinking Candles

Similarly, if the chart is a five-minute one, each bar represents five minutes. In this article, we will highlight some of the best candlestick patterns and how to use them in the market. Engulfing patterns won’t occur after every pullback, which means potentially missed opportunities.

Bitcoin shows bullish signals, may surge to $28,000 according to … – Investing.com Canada

Bitcoin shows bullish signals, may surge to $28,000 according to ….

Posted: Fri, 08 Sep 2023 18:38:35 GMT [source]

In the example above, the proper entry would be below the body of the shooting star, with a stop at the high. Conversely, a bearish candle is assumed when the closing price is lower than the opening price. In other words, the price dropped in the amount of time it took for the candle to form. The open tells us where the stock price opens at the beginning of the minute.

Let us explain the structure of a single candlestick through pictorial representation. Daniels Trading is division of StoneX Financial Inc. located in the heart of Chicago’s financial district. Established by renowned commodity trader Andy Daniels in 1995, Daniels Trading was built on a culture of trust committed to a mission of Independence, Objectivity and Reliability.

- Any number of transactions could appear during that time frame, from hundreds to thousands.

- Traders interpret this pattern as the start of a bearish downtrend, as the sellers have overtaken the buyers during three successive trading days.

- Second, there are volatile markets, which happens when assets are moving in wider ranges.

- So read this post till the end to know how I make use of them and how you can too, to generate your daily return.

- Short and small bodies indicate a little buying or selling activity.

These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. The bullish harami is the opposite of the upside-down bearish harami. A downtrend is in play, and a small real body (green or white) occurs inside the large real body (red or black) of the previous day. If it is followed by another up day, more upside could be forthcoming. Patterns are separated into two categories, bullish and bearish.

Brief History of candlesticks

They also have long wicks on both sides indicating a large variance between the high and low prices. Traders can take advantage of hammer formations by executing a long trade once the hammer candle has closed. Hammer candles are advantageous because traders can implement ‘tight’ stop-losses (stop-losses that risk a small amount of pips). Take-profits should be placed in such a way as to ensure a positive risk-reward ratio. The close price is the last price traded during the period of the candle formation.

The bars on a tick chart develop based on a specified number of transactions. So, a 415 tick chart creates a new bar for every 415 transactions, for example. Bar charts effectively extend line charts, adding the open, high, low, and close. They remain relatively straightforward to read while giving https://g-markets.net/ you some crucial information line charts fail to do. Short-sell triggers signal when the low of the hanging man candlestick is breached with trail stops placed above the high of the hanging man candle. If the price hits the red zone and continues to the downside, a sell trade may be on the cards.